Investments

Multi-Family

Industrial

Healthcare

Office

INVESTMENTS

Partnering with a qualified commercial brokerage is crucial to the successful of any real estate transaction. Whether you are selling, buying or leasing a commercial property it’s important that you are represented by a firm that is an expert in their local market and can navigate these uncertain times.

Commercial real estate can be broken down into several different categories. At a high level, when people think of different types of commercial real estate, they typically think about shopping centers, office buildings, or warehouses. But the commercial real estate industry is much more precise when it comes to defining property types. Below are different types of commercial real estate that we specialize in along with a description of how each category is typically defined.

MULTI-FAMILY

For investors who are transitioning from residential to commercial real estate investing, multifamily properties offer an easier path than other investments since the tenant base is familiar.

Multiple tenants within a single property create multiple income streams, which mitigates the overall financial risk of the investment. If one tenant moves out of an apartment complex, your bottom line won’t notice a big hit since you have multiple tenants paying rent also.

Multifamily assets include everything from duplexes with two tenants to apartment buildings housing hundreds.

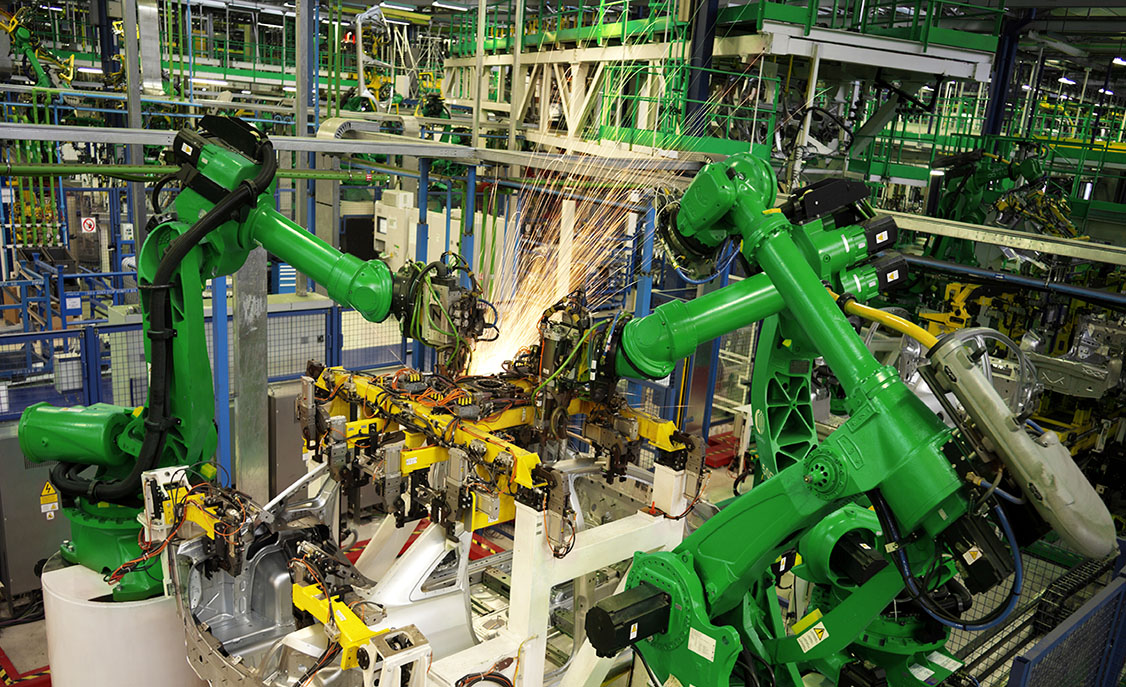

INDUSTRIAL

Industrial properties offer a wide range of asset classes which have taken off over the last economic cycle thanks to the demands of online shopping.

In terms of looks, they may not be the “sexiest” but often times industrial can be one of the best real estate assets to invest in thanks to its flexibility of use and lower cost of entry.

Tenants oten stay in one location for 10 to 30 years so the turn over is very low.

HEALTHCARE

This technology goes beyond unreliable data based on imaginary boundaries such as zip codes, city lines, and county lines. Using this technology allows us to see natural and manmade barriers to a geographical region that impacts demographics. Giving you a clearer picture of why certain areas are better than others.

OFFICE

Office spaces are broken up into several classes; Class A, Class B, and Class C assets depending on their age and quality.

Investing in office space is more capital-heavy than other types of commercial real estate due to the cost of building out space for incoming tenants. Although, due to the cap rate valuation office space commands some of the highest values.

Stay In Touch